A new report from Jon Peddie Research has revealed that year-to-year total GPU shipments, which include all platforms and all types of GPUs, decreased by -25.1%, desktop graphics decreased by -15.43%, and notebooks decreased by -30%, amounting to what the marketing, research, and management consulting firm has described as the biggest drop since the 2009 recession:

Jon Peddie Research reports the growth of the global PC-based graphics processor unit (GPU) market reached 75.5 million units in Q3’22 and PC CPU shipments decreased by -19% year over year. Overall, GPUs will have a compound annual growth rate of 2.8% during 2022–2026 and reach an installed base of 3,138 million units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPUs) in the PC will grow to reach a level of 26%.

Year-to-year total GPU shipments, which include all platforms and all types of GPUs, decreased by -25.1%, desktop graphics decreased by -15.43%, and notebooks decreased by -30%—the biggest drop since the 2009 recession.

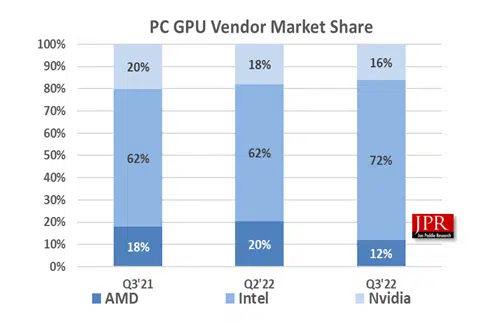

Jon Peddie Research goes on to share a chart that reveals AMD’s overall market share percentage from last quarter decreased by -8.5%, Intel’s market share increased by 10.3%, and NVIDIA’s market share decreased by -1.87%.

Further highlights:

- The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktop, notebook, and workstations) to PCs for the quarter was 115%, down -6.0% from last quarter.

- The overall PC CPU market decreased by -5.7% quarter to quarter and decreased -by 18.6% from year to year.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) decreased by -33.5% from the last quarter.

- This quarter saw 0.5% change in tablet shipments from last quarter.

“The third quarter is usually the high point of the year for the GPU and PC suppliers, and even though the suppliers had guided down in Q2, the results came much below their expectations,” Peddie noted.

“All the companies gave various and sometimes similar reasons for the downturn: the shutdown of crypto mining, headwinds from China’s zero-tolerance rules and rolling shutdowns, sanctions by the US, user situation from the purchasing run-up during Covid, the Osborne effect on AMD while gamers wait for the new AIBs, inflation and the higher prices of AIBs, overhang inventory run-down, and a bad moon out tonight.”

“Generally, the feeling is Q4 shipments will be down, but ASPs will be up, supply will be fine, and everyone will have a happy holiday.”