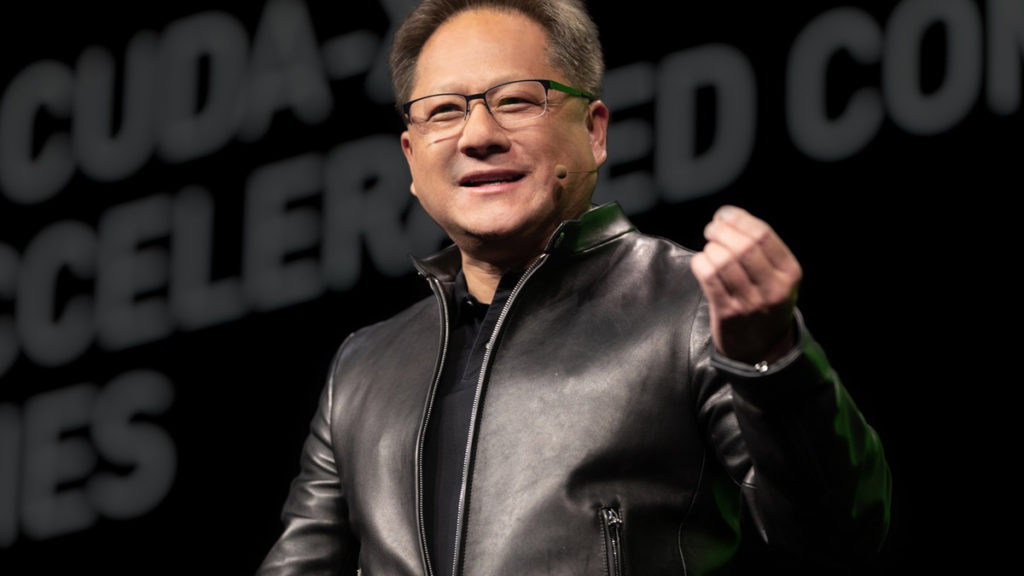

NVIDIA CEO and founder Jensen Huang has just achieved the unusual status of having greater personal wealth than that of a rival company. It is not unheard of to see reports of individuals whose extreme wealth puts them on the list of the richest but it is a bit rare to see an individual’s wealth compared against that of a rival company, and this has just occurred with Jensen Huang vs Intel. According to a report from two days ago, the NVIDIA CEO, president, and founder has a net worth of $109.2 billion while Intel, following many financial woes over the last two years, was at $96 billion. This achievement has even spurred social media users to suggest that Huang should pull the trigger to buy out Intel.

Do it Jensen! I know you’re thinking about it

— Thomas Millar (@thmsmlr) October 5, 2024

It’d be hilarious. We all support you pic.twitter.com/PIyyC1wDAb

Per Tom’s Hardware:

- “Nvidia CEO Jensen Huang’s current net worth is listed at $109.2 billion, putting him a significant valuation step ahead of Intel, whose stock price took a beating when its financial troubles were made public in August.”

- “The news has gotten to the point that various social media users have been sharing posts about it.”

Now joking aside, it’s highly unlikely that the NVIDIA CEO would attempt a personal takeover of Intel. From the legal challenges in getting a deal worked out and approved by regulatory authorities from around the world to then having to put plans into place for running it, such a move could be more problematic than beneficial for Huang. Factor in the current ongoing astronomical trajectory with NVIDIA’s AI and data center profits it becomes even more of a why bother scenario. NVIDIA briefly also managed to overtake Microsoft this summer with its then $3.34 trillion market cap value to, for a moment, become the world’s largest public company. Team Green has also managed, at different times, to surpass Apple, Google, and Amazon as well in 2024.

There have been numerous stories pointing to the incredulous profits NVIDIA has made and is projected to keep making, with its AI tech. With customers such as Elon Musk and Larry Ellison waiting in the wings to buy as many products as the company can produce the end is still not quite in sight. Add in also that its consumer GPU products reportedly dominate 80% of the market and competition becomes more of an afterthought for the green tech juggernaut.

From Intel’s woes to a potential AI bubble burst

Intel’s woes are no secret and have put it at the precarious edge of being delisted from the Dow Jones Industrial Average if things don’t improve. From a major lay-off strategy that began in 2023 and might continue through 2025, to consumer product issues, and other losses, Intel has been in the midst of economic challenges. However, Intel has been hard at work in securing funds and working deals to get itself back on its feet.

Meanwhile, NVIDIA is all-in with its AI tech that has projected profits continuing to hit epic levels for years to come, that is if the AI bubble doesn’t burst before then. There have been reports this could happen and there are other moving parts to consider ranging from lower-cost competitor options to overall customer demand for AI products and services.