The world’s third-largest foundry by revenue is looking to expand. In an interview with Reuters, GlobalFoundries CEO Thomas Caulfield discussed bold plans for the company’s future. From doubling its investments and opening new plants to an earlier IPO, there are many things on the horizon. The ongoing effects of the global pandemic have led to an aggressive strategy for the chip manufacturing company.

Caulfield said that prior to the pandemic, chip manufacturing growth was only expected to increase by 5 percent over five years. The new forecast is double that. The increased demand from the automotive and electronics sectors has led to global shortages. Competitors Samsung and TSMC have also been struggling to meet the new demand. GlobalFoundries expects a 9 to 10 percent increase in revenue growth over the coming year, which could happen if it can achieve a 13 percent production growth in 2021 and then 20 percent in 2022.

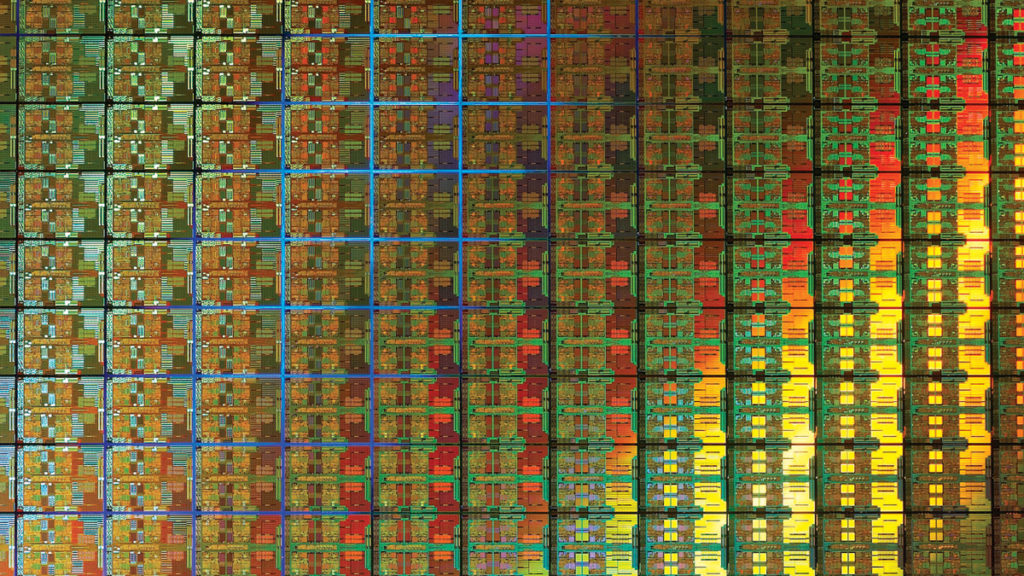

GlobalFoundries is laying out a number of plans to meet these demands. It will be investing $1.4 billion in 2021 to increase production at three factories around the world for its 12 nm to 90 nm processes. Roughly a third of that investment will come from customers seeking to secure inventory. Anandtech notes that GlobalFoundries spends $700 million on expansion in a typical year. Furthermore, it may build a new plant in New York after securing 66 acres. Lastly, it may bring forward its IPO to late 2021 or the first half of next year.