Apple is traditionally TSMC’s biggest customer, but it appears that Intel has made a superior offer that will allow the company to be the first to leverage one of the world’s largest semiconductor foundry’s most cutting-edge processes.

According to a report from Chinese publication UDN, Intel has won pretty much all of TSMC’s initial 3-nanometer production for its next-generation products, which reportedly include three server processors and a GPU. These will be churned out via TSMC’s 18b fabrication site, with mass production supposedly beginning as early as mid-2022.

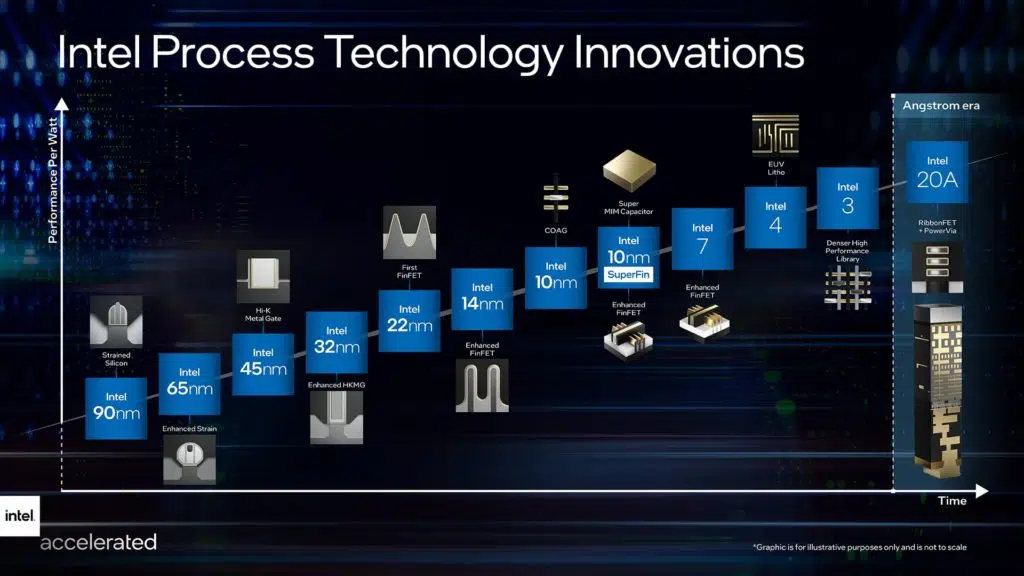

Intel recently shared a new roadmap that confirmed a variety of its upcoming nodes, all bearing a different naming convention. One of these is Intel 4, an innovation that “fully embraces EUV lithography to print incredibly small features using ultra-short wavelength light.” Intel noted that these products would be ready for production in the second half of 2022.

TSMC isn’t keen on commenting on its customers’ orders, but chairman Liu Deyin recently suggested to shareholders that Intel was eager to adopt the company’s most innovative technologies.

The first batch is about 4,000 pieces. The product design should be completed in TSMC’s Bamboo Branch 12 factory recently. The finalized products have begun to be moved to Nanke 18b for mass production; these four products will be officially produced and delivered in May next year, and will be mass-produced in July next year.

Source: UDN