IDC has a sunny forecast to share for enthusiasts who have grown tired of hearing about the chip shortage in tech headlines.

According to a new report by the analyst firm, the semiconductor market is growing at such a positive rate that normalization should be reached by the middle of 2022. That’s excellent news in itself, but IDC goes on to suggest that the expansions will be so effective that the industry may end up with an oversupply of chips in 2023.

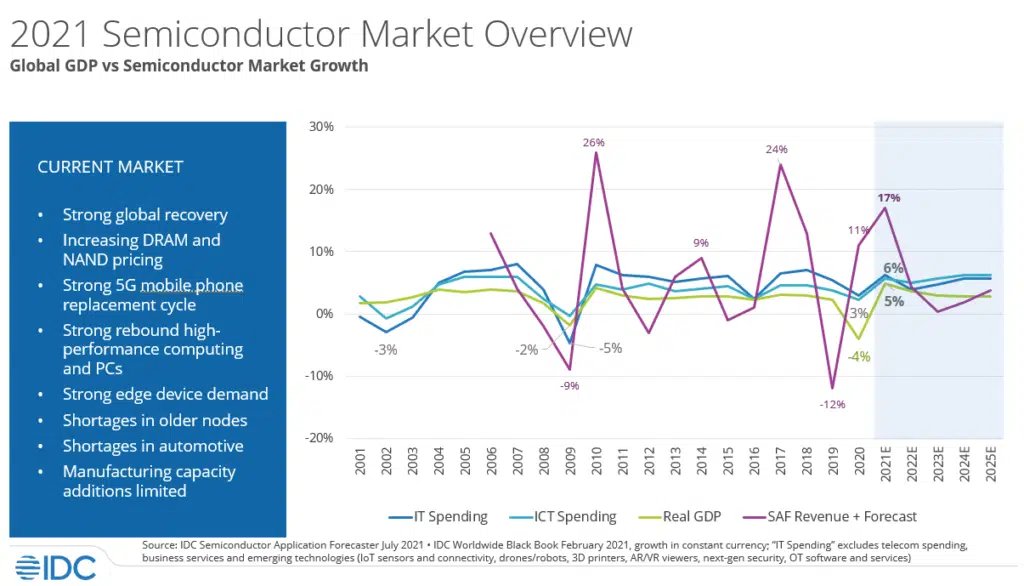

IDC expects the semiconductor market to grow by 17.3 percent in 2021 versus 10.8% in 2020. According to IDC, the industry will see normalization and balance by the middle of 2022, with a potential for overcapacity in 2023 as larger scale capacity expansions begin to come online towards the end of 2022.

In terms of the more immediate future, IDC clarified that dedicated foundries are currently fully allocated for the rest of year, with capacity utilization at nearly 100 percent. Semiconductor wafer prices are also expected to continue increasing for the rest of 2021 due to material costs and other reasons.

“The semiconductor content story is intact and not only does it benefit the semiconductor companies, but the unit volume growth in many of the markets that they serve will also continue to drive very good growth for the semiconductor market,” says Mario Morales, Group Vice President, Enabling Technologies and Semiconductors at IDC.

Source: IDC (via The Register)