What game company is Microsoft going to acquire next? If Phil Spencer stumbled upon a genie bottle, it’d most definitely be Nintendo, according to a leaked internal email from 2020 that involves the head of Xbox calling Nintendo the “prime asset” for a potential acquisition. Spencer said that Microsoft is one of the few U.S. companies that stands a chance of owning Nintendo, although there are some challenges in the way, such as the Switch maker already having “a big pile of cash.”

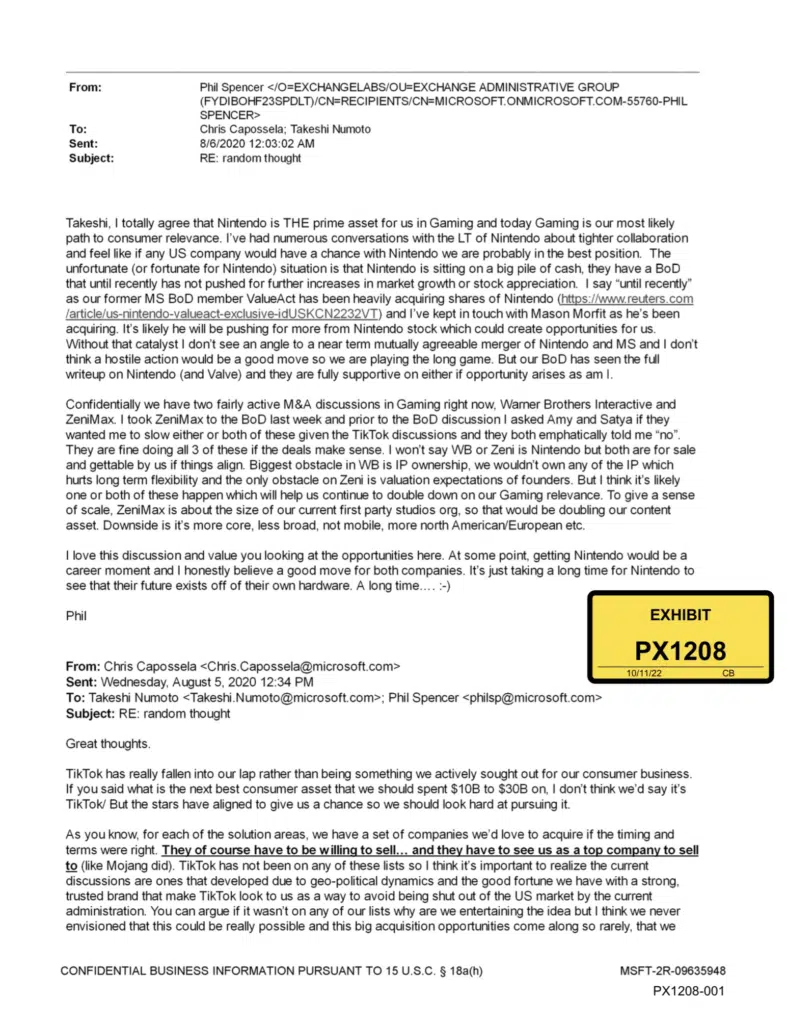

Takeshi, I totally agree that Nintendo is THE prime asset for us in gaming, and today gaming is our most likely path to consumer relevance. I’ve had numerous conversations with the LT of Nintendo about tighter collaboration and feel like if any US company would have a chance with Nintendo, we are probably in the best position. The unfortunate (or fortunate for Nintendo) situation is that Nintendo is sitting on a big pile of cash; they have a BOD that until recently has not pushed for further increases in market growth or stock appreciation. I say “until recently,” as our former MS BOD member ValueAct has been heavily acquiring shares of Nintendo (https://vwm.reuters.com /article/us-nintendo-valueact-exclusive-idUSKCN2232VT) and I’ve kept in touch with Mason Morfit as he’s been acquiring. It’s likely he’ll be pushing for more from Nintendo stock, which could create opportunities for us. Without that catalyst, I don’t see an angle to a near-term, mutually agreeable merger of Nintendo and MS, and I don’t think a hostile action would be a good move, so we are playing the long game. But our BOD has seen the full writeup on Nintendo (and Valve) and they are fully supportive on either if opportunity arises, as am l.

Confidentially, we have two fairly active M&A discussions in Gaming right now, Warner Brothers Interactive and ZeniMax. I took ZeniMax to the BoD last week, and prior to the BoD discussion, I asked Amy and Satya if they wanted me to slow either or both of these given the TikTok discussions, and they both emphatically told me “no.” They are fine doing all 3 of these if the deals make sense. I won’t say WB or Zeni is Nintendo, but both are for sale and gettable by us if things align. Biggest obstacle in WB is IP ownership; we wouldn’t own any of the IP, which hurts long-term flexibility, and the only obstacle on Zeni is valuation expectations of founders. But I think it’s likely one or both of these happen, which will help us continue to double down on our relevance. To give a sense of scale, ZeniMax is about the size of our current first-party studios org, so that would be doubling our content asset. Downside is it’s more core, less broad, not mobile, more north American/European, etc.

I love this discussion and value you looking at the opportunities here. At some point, getting Ninterdo would be a career moment, and I believe a good move for both companies. It’s just taking a long time for Nintendo to see that their future exists off of their own hardware.