A new report shows that OLED monitor shipments for 2024 are on track to reach 1.44 million units sold with continued momentum in 2025 and 2026. OLED display technology which was once limited to a few manufacturers that offered premium-priced 4K models is becoming more widely available and affordable. The market continues to expand with offerings for 1440p and 4K resolutions, an assortment of features such as higher refresh rates, OLED care for burn-in prevention, and panel sizes. Newer 31.5″ models are also believed to drive increased sales in the coming months making for an estimated 181% YoY growth of OLED monitor shipments in 2024.

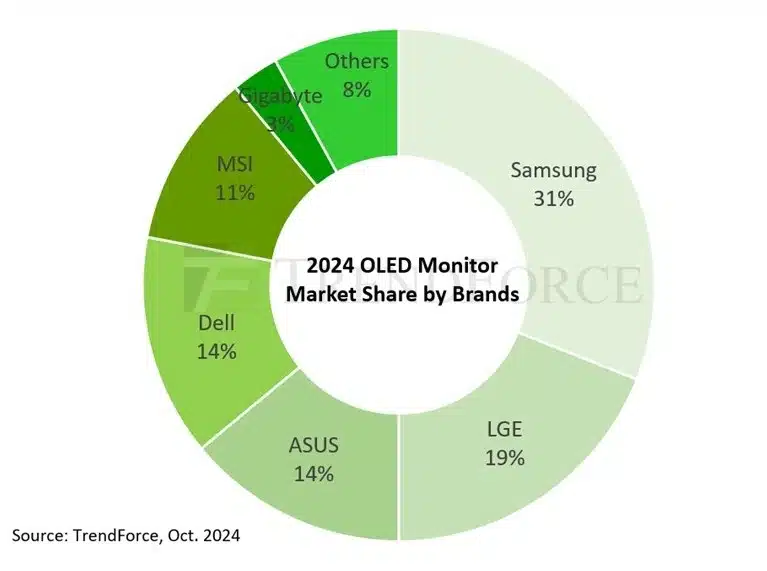

According to Trendforce’s new report, Samsung is forecast to hold the majority market share at 31%, largely thanks to its established line of 49″ ultra-wide 32:9 monitors which provide users with a seamless dual monitor experience. Samsung is expected to further dominate the market with its QD-OLED monitors. QD-OLED panels have gained a 20% significant foothold in the monitor segment going from 53.5% in 2023 to 73% this year. LGE ranks in with 19% of projected sales with the two combined making up half of the expected OLED monitor shipments for 2024.

Per Report:

- “LGE, leveraging ample panel resources and continuous product line expansion, is poised to take second place with a projected 19% market share.”

- “QD-OLED monitors are set to dominate the market, driven by Samsung Display’s aggressive production ramp-up and multiple brands introducing QD-OLED models.”

- “MSI’s aggressive expansion into new sales channels has resulted in substantial growth in overall monitor shipments, with the company recording the highest growth rate across all categories.”

While Dell and ASUS seem poised to battle it out for 3rd place, and each offering high-end models, MSI is noted with strategic sales growth that could reach close in with around 11% projected shipments and has the highest growth among all reported categories. This leaves GIGABYTE who while expected to see more shipments before the year’s end with new product launches, is at 3%. There are a number of lesser-known brands whose combined projected sales seemingly outnumber GIGABYTE at 8% but smaller brands often tend to have much less regional sales options and support. Trendforce has also noted that monitor shipments featuring WOLED technology will have significantly lower foreseeable sales with a 26% drop before the year’s end.