With shipments totaling 68.5 million units in the third quarter of 2023, the global PC market managed to outperform expectations. But that volume was still down 7.2% compared to the same quarter in 2022, according to the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

Despite the PC market surpassing initial forecasts, both driving and inhibiting factors influenced this performance. First, the increased volume can partly be attributed to inventory restocking, mostly on the consumer side. Second, there was a notable effort to address anticipated cost escalations, such as expected increases in India import duties. Although these duties were later suspended, such concerns nonetheless led to the channel absorbing more units than likely necessary. Finally, further tightened IT budgets led business PC units to underperform against an already conservative commercial forecast.

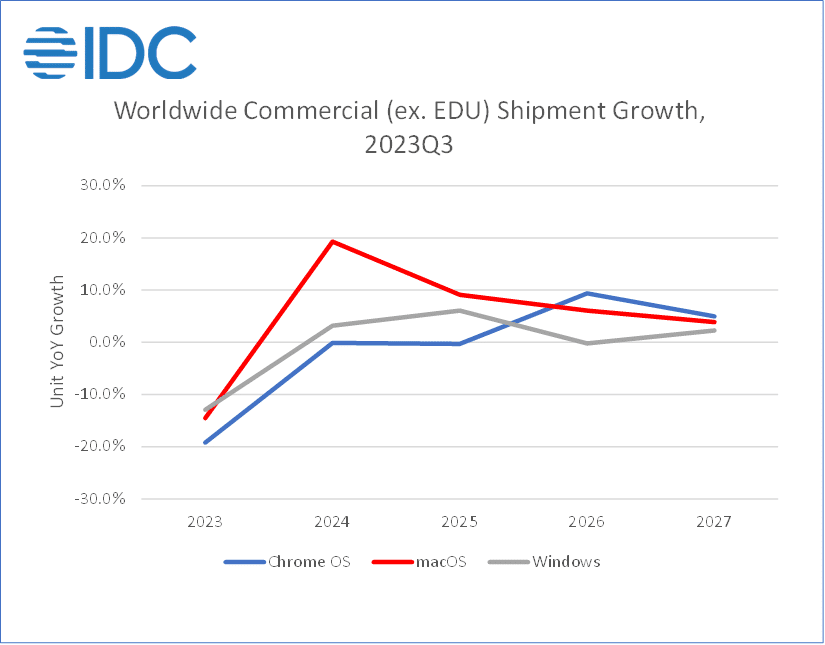

Given current conditions and a tenuous macroeconomic environment, IDC has lowered its forecast for the worldwide PC market. 2023 shipment volume is now expected to decline 13.8% compared to 2022, which itself declined 16.6% over the previous year. Two consecutive years of double-digit year-over-year drops is an unprecedented trend in the PC market but will likely contribute to a recovery thereafter. Despite the short-term challenges, IDC continues to expect a market rebound in 2024 and beyond with many factors converging within the next two years. A few of the main drivers include:

- PC Refresh Cycle: The vast and aging installed base of commercial PCs surpassing the four-year mark by 2024 is expected to necessitate a refresh, coinciding with the pressing demand to migrate toward Windows 11. The total PC market of 2024 should see growth of 3.4% compared to 2023.

- AI Integration: The integration of AI capabilities into PCs is expected to serve as a catalyst for upgrades, hitting shelves in 2024 and at first aimed toward certain segments of the enterprise PC market. Over time, further advancement in use cases and cost reductions could spread to the broader market.

- Continued evolution and recovery of the consumer installed base: The collective influence of these factors positions 2024 as a pivotal year for the PC market, offering a respite from recent challenges. Beyond 2024, growth is expected to surpass pre-pandemic shipment levels and culminate in 285 million units by 2027.

“Perhaps historical context can offer some consolation to the tough slog the PC ecosystem is going through,” said Jay Chou, research manager for IDC Mobility and Consumer Device Trackers. “While we still expect eight consecutive quarters of year-over-year volume declines from Q1 2022 through Q4 2023, it still pales to the 19 consecutive quarters of year-over-year PC declines from Q2 2012 to Q4 2016. Furthermore, notebooks are already at higher levels than 2019, signaling a sizable expansion of the notebook market even after COVID-induced purchases have subsided. We maintain that factors like hybrid work, commercial refresh, and growth in premium PCs can lead to a compound annual growth rate of 3.1% from 2023 through 2027.”

Notes:

Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release.

Shipments include shipments to distribution channels or end users. OEM sales are counted under the company/brand under which they are sold.